With oil prices remaining highly volatile there are many forecasts and predictions circulating in the public domain. While many of these forecasts and predictions rely on uncertain assumptions about interdependent factors we wanted to use our TGS Well Performance Data to look at implications of certain cost cutting measures.

Reducing cost is top of mind for all operators, and especially so for short-cycle shale producers.

The two initiatives operators are pursuing are:

- Reducing Capex by reducing rig count and frac crews

- Reducing Opex by potentially shutting in lower producing wells

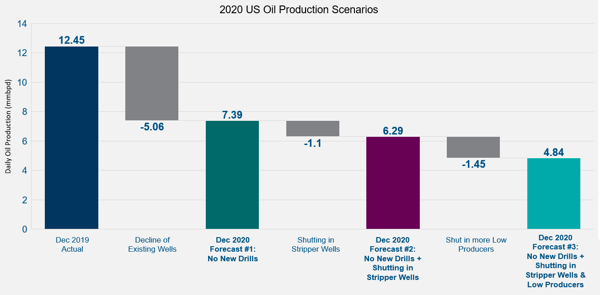

We put together forecasts for three different scenarios, all representing extreme courses of action and worst case situations:

- No New Drills: What would average daily oil production in December 2020 look like if all operators stopped drilling in May and there were no new wells coming online?

- No New Drills + Shutting In Stripper Wells: What if in addition operators decided to also shut in the lowest of the low producers, i.e. stripper wells producing less than 15 bpd?

- No New Drills + Shutting In Stripper Wells and more Low Producers: What if the previous Capex and Opex reductions weren’t enough and operators also shut in Low Producers with less than 100 bpd, a threshold commonly referenced?

Our models predict that:

- Discounting all drilling and fracking activity for the rest of the year going forward, total US production would decline by 40%.

- Shutting in wells producing less than 100 bpd would result in a further decrease of 20%, or 2.55 mmbpd.

Figure 1 – Oil Production Scenarios

Figure 1 – Oil Production Scenarios

Observations:

- Scenario #1: Compared to average daily production for December 2019, not bringing any new wells online starting in May results in a reduction of about 40% by the end of the year. This illustrates the contribution of rapidly declining shale wells which make up a substantial portion of today’s US production.

- Scenario #2: If in addition to laying down rigs and frac crews, operators also shut in super low producing stripper wells, US oil production would be cut in half by the end of the year.

- Scenario #3: If operators also decided to shut in other low producers (<100 bpd), another 1.45 mmbpd would be taken offline.

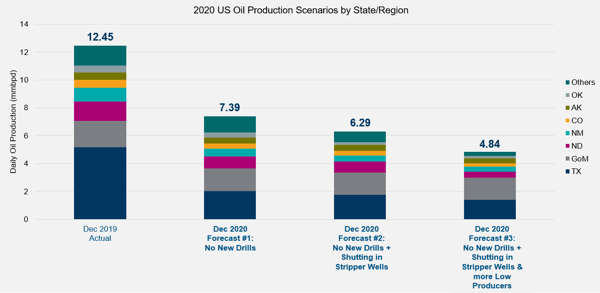

Texas is the state most impacted in all scenarios due to the level of drilling activity and amount of producing wellbores compared to other states. New well production makes up 60% of production illustrating the impact of a concentration of unconventional basins in the state.

Gulf of Mexico production is fairly stable between all scenarios and compared to 2019. The GoM shows a significantly lower level of new wells coming online every year, so a drop in drilling activity will have little impact on overall production. In addition, these wells have significantly higher flow rates and significantly lower declines than onshore wells, and none fall in the stripper well or low producer <100 bpd categories.

This analysis is part of a series of quick insights we are releasing in light of the current environment and will be publishing over the next weeks. Future articles will address the following questions:

- Does shutting in wells result in a decrease in long-term performance?

With operators considering shutting in less profitable wells, we will compare productivity before and after shut-in and investigate the impact of shut-in time on the potential degradation in long-term performance.

- How do Drilled but Uncompleted (DUC) wells perform compared to wells completed right after drilling?

Since fracking costs can make up more than 50% of total well cost, deferring completions is a popular way to develop inventory that can be brought online quickly when prices recover while fulfillling drilling and lease obligations. We will look at data from the last downturn in 2014 to see how DUCs compare to regular wells in terms of long-term productivity.

Figure 2 – Oil Production Scenarios by State/Region

Figure 2 – Oil Production Scenarios by State/Region