Earlier this month the Biden administration unveiled a $2.25 trillion infrastructure proposal. This wide- ranging bill has generated attention in the energy sector due to high-profile sections related to plugging abandoned wells which could potentially be a boon to the energy services sector. But will the proposed funding be enough to make a dent in the abandoned wells problem? Are there other potential aspects of this proposal that could impact the energy sector? Although the exact text of the proposed bill is not yet available, the administration has released a fact sheet which will be used as a primary source for what will eventually be included in the bill. Let’s take a closer look.

The policy currently generating the most buzz is the $16 billion well and mine cleanup provision. The respective section of the fact sheet[1] details the scope of the problem to be addressed. The prescribed solution for “hundreds of thousands of former orphan oil and gas wells and abandoned mines” is an “up-front investment of $16 billion [to plug] oil and gas wells,” with a secondary goal of “[reducing] the methane and brine that leaks from these wells.”

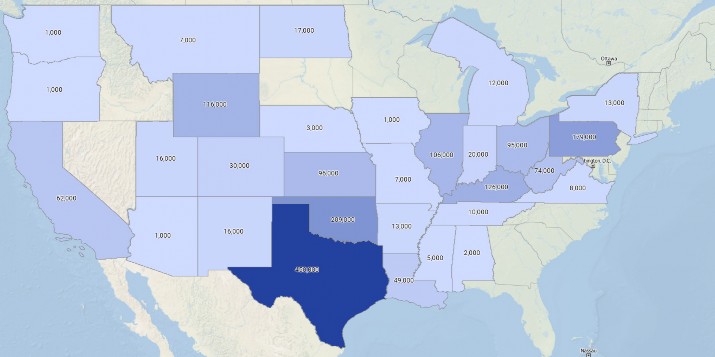

In Abandoned Wells – How big is the problem, and what can be done?[2]we took a deep dive into the state of abandoned and orphaned wells in the U.S. Our results indicated that there are around 1.5 million abandoned and orphaned wells [Fig 1], which would cost approximately $90 billion to address.

Based on the language and funding levels included, it seems that this provision would only be targeting orphaned wells rather than the larger subset of abandoned wells still owned by operators. The first order impact will be an immediate boon to oilfield service providers, supplying a revenue stream that will allow for investment in re-hiring workers and picking up workover rigs. Although operators with large abandoned well inventories likely will not get any direct funding, they could also see a beneficial second

order effect. As federal funding facilitates an increase in supply of plugging rigs and crews, the market price for plugging could decrease, providing operators an opportunity to reduce the liability of abandoned wells on the balance sheet.

Abandoned Wells – How big is the problem, and what can be done?

TGS analysis shows that the total amount of abandoned and orphaned well in the U.S. is around 1.5 million. TGS data, using a combination of reported well statuses, plugging reports, well production records, and other reported and inferred data attributes, estimates 420,000 wells in Texas, 174,000 wells in Pennsylvania, 212,000 wells in Oklahoma, and 114,000 wells in Wyoming that are very likely abandoned or orphaned.

TGS Well Performance Data makes the important distinction between an abandoned well and an orphaned well using state regulatory agency data and proprietary historical data sets. An abandoned well is any well that has been shut in and is effectively at the end of its productive life, but which has not yet been plugged. An orphaned well is an abandoned well that, for a number of potential reasons, has had ownership transferred from the previous operator to a state regulatory agency.

Other provisions referenced in the fact sheet could also benefit a growing number of oil and gas operators looking to expand into renewable energies. The section titled “Establish the United States as a leader in climate science, innovation, and R&D” details how $35 billion could be directed towards renewable energy sources and carbon capture and sequestration projects. The major line item here is “$15 billion in demonstration projects for climate R&D priorities, including utility-scale energy storage, carbon capture and storage.” Carbon storage and sequestration are emerging as a potentially useful option for depleted oil and gas reservoirs. Subsurface data and expertise will play a critical role in those projects and create additional revenue opportunities for operators and service companies alike.

Figure 1 – Abandoned Onshore Wells by State

Figure 1 – Abandoned Onshore Wells by State

Carbon Capture and Storage

TGS, alongside other energy data specialists, recognizes the contribution it can make to developing a more sustainable energy future. The use of seismic data from TGS in the development of the landmark Teesside net-zero cluster CCUS project in the U.K., for example, is an important initiative for the company as it marks the start of what could become a growing business area in the coming years. TGS recognizes the need to actively engage in projects that support the energy transition. Working with Net Zero Teesside is a recognition that its data can and will be used in new ways in the future.

One aspect of the proposal that appears to have been overlooked is a potential crossover between abandoned wells and innovation in renewable energies. Abandoned wells drilled to deep target formations, like many in the Permian basin in Texas (the state with the most abandoned wells), could be repurposed for small- scale geothermal energy generation. As described in Repurposing Oil and Gas Well Data for Geothermal Prospecting[3], typically, higher temperatures (>275°F) with high flow rates (>10,000 bls/day) are appropriate for electrical production on-site use in agriculture or industry, small electrical production, and district or building heating and cooling. Once converted, these geothermal units could serve a range of local needs and serve as a new revenue stream from once retired infrastructure.

Despite various revenue opportunities for operators and service providers, the proposed bill also includes a number of adverse provisions such as increasing the corporate tax rate and eliminating “subsidies” for the energy industry. The fact sheet does not provide any specifics, but promises that “billions of dollars in subsidies, loopholes, and special foreign tax credits for the fossil fuel industry” would be eliminated. Both of those provisions have drawn bipartisan criticism[4]. While additional investment in the oilfield to plug abandoned wells or convert wells at the end of their lifecycle into geothermal units is welcome, we will likely see extensive negotiation due to part of the current proposal that are harmful to the industry.

Repurposing Oil and Gas Well Data for Geothermal Prospecting

The use of existing TGS data, analysis, and available tools provides resource exploration opportunities for both the oil and gas and geothermal communities. Such data includes:

Oil and gas well performance/production data:

- Decline curve analysis

- Forecast economic limit – end of economic life

- Maximum and sum (average max daily rate)

- Well completion data

- Completed zones, perforated intervals (depth, formation)

- Casing diameters

- Completion histories

Basin temperature data and models

- Gradient-based corrected subsurface formation temperatures

A bipartisan group of senators has simultaneously released an unrelated proposal[5], called the REGROW act, which would also address federal funding for plugging orphaned wells. This bill would allocate $4.275 billion for orphaned well remediation on state and federal land and another $400 million for orphaned well remediation on public land. Although this proposal includes less than half of the funding promised by the Biden infrastructure plan, the highly targeted nature of the REGROW act may appeal to a broader range of lawmakers, increasing the likelihood of being passed into law.

References:

- Fact Sheet: The American Jobs Plan: https://www.whitehouse.gov/briefing-room/statements- releases/2021/03/31/fact-sheet-the-american-jobs-plan/

- https://www.tgs.com/well-intel/well-intel-abandoned-wells-how-big-is-the-problem-and-what-can-be-done

- https://www.tgs.com/articles/repurposing-well-data-for-geothermal

- Biden says he’s open to compromise with Republicans on $2 trillion infrastructure plan - The Washington Post: https://www.washingtonpost.com/us-policy/2021/04/07/yellen-corporate-tax-infrastructure/

- https://www.hartenergy.com/news/bipartisan-senate-bill-would-direct-billions-plugging-wells-193525