The 2023 M&A Boom Propels Permian Oil Deals to Historic Heights, Surpassing the Staggering Milestone of $100 Billion in Transactions

This week, Occidental dominates the spotlight with its strategic move to buy Midland-based CrownRock in a significant $12 billion deal, view official press release. The transaction is expected to close in the first quarter of 2024, and it will strengthen Occidental’s position notably by expanding its presence in the prolific Permian Basin.

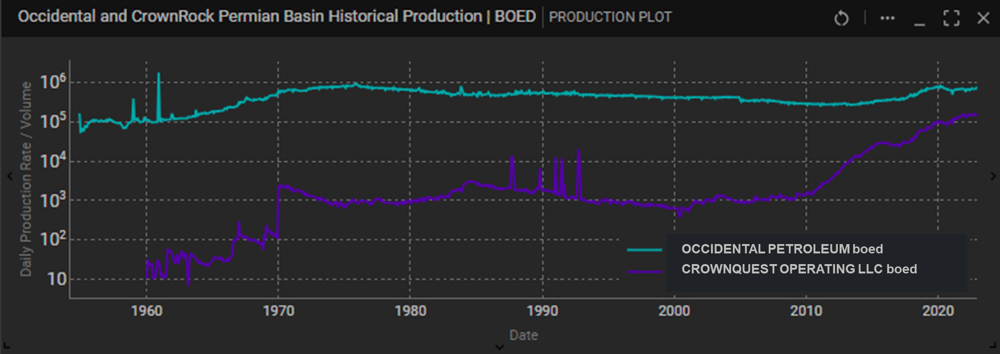

Figure 1 illustrates Occidental (Teal) and CrownQuest (the operator of CrownRock acreage; Purple) wells focusing on the Permian Basin region. CrownQuest possesses a range of ready-to-develop assets that will enhance Occidental's holdings in the Midland Basin. According to Occidental’s press release on Monday, these assets come with reserves having a low breakeven point, which is expected to yield a higher long-term return on investment. .png?width=1001&height=568&name=MicrosoftTeams-image%20(20).png)

Figure 1. Occidental and CrownQuest’s wells focusing on the Permian Basin region, overlay of TGS Permian Basin Stratigraphic Model outline (green). Figure generated using TGS Well Data Analytics.

CrownQuest’s 94,000+ net acres of premium stacked pay assets and supporting infrastructure are well positioned alongside Occidental’s legacy Midland Basin assets and is anticipated to add high-margin, lower-decline unconventional production equating to ~170,000 barrels of oil equivalent per day (boed) in 2024. These new leaseholds are reported to add approximately 1,700 undeveloped locations. According to TGS Well Data Analytics, Occidental should expect to increase their total Midland Basin current production by 142,000 boed (Figure 2).

Figure 2. Occidental and CrownRock Permian Basin historical production. Plot generated using TGS Well Data Analytics.

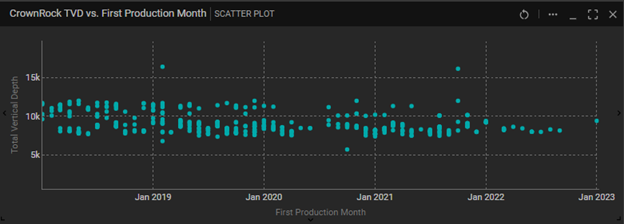

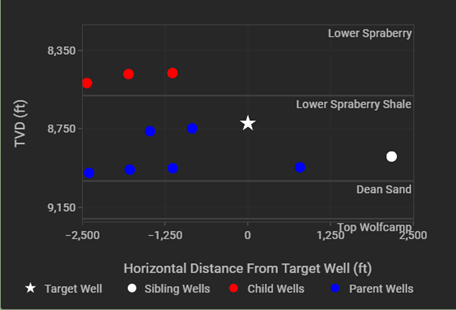

Plotting TVD against first production month shows that CrownRock has historically drilled wells spanning a wide range of depths and target zones. Around 2018, they appear to have narrowed their focus to a 2,000 ft interval (Figure 3). Cross-referencing these wells with a gun-barrel diagram, including TGS formation tops, shows that the corresponding target formations include the Lower Spraberry and Lower Spraberry Shale (Figure 4). CrownRock’s older parent wells in this example, land in the deeper Lower Spraberry Shale Formation and the newer child wells target the shallower Lower Spraberry Formation. TGS data illuminates this change by revealing a higher average boe IP90 per foot for the Lower Spraberry wells compared to the Lower Spraberry Shale wells.

Figure 3. CrownRock wells True Vertical Depth (TVD) vs. Time. Chart generated in TGS Well Data Analytics.

Figure 4. TGS Well Data Analytics Gun Barrel Diagram for an average CrownRock well in the Midland Basin

This year has witnessed a historic milestone with the value of mergers and acquisitions in the U.S. oil and gas sector soaring to over $100 billion, propelled by a series of multi-billion-dollar deals with a focus on the Permian Basin. This year's aggregate expenditure on mergers and acquisitions in the primary U.S. shale field marks the highest since $65 billion in 2019, led by Occidental Petroleum Corp’s Anadarko deal.

The latter half of the year marked significant announcements, with both Exxon and Chevron unveiling deals surpassing the $50 billion mark.

Additional transactions in the Permian Basin comprised Permian Resources’ $4.5 billion offer for Earthstone Energy and Ovintiv’s $4.3 billion investment in three acquisitions within the Permian Basin. Civitas Resources allocated a total of $4.7 billion for the acquisition of two privately-owned properties in the Permian, Tap Rock Resources and Hibernia Energy.

With TGS Well Data Analytics, this type of comparative analysis and benchmarking can be done in minutes. For more information on Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.