BOEM postpones Oil & Gas Lease Sale 261 in US Gulf of Mexico, decision was taken to comply with court injunction in Louisiana

The United States Bureau of Ocean Energy Management (BOEM) has decided to delay the scheduling of a forthcoming offshore oil and gas lease sale in the Gulf of Mexico by over a month. Initially set for September 27th, the US government had designated Lease Sale 261 for this date, which offers 12,395 blocks on about 67 million acres in the Western, Central and Eastern Planning Areas in the Outer Continental Shelf. However, due to a court injunction filed in Louisiana, BOEM has now announced its intention to conduct this lease sale no later than November 8, 2023 and will include lease blocks that were previously excluded due to concerns from environmental groups regarding potential impacts to the Rice whale population in the Gulf of Mexico.

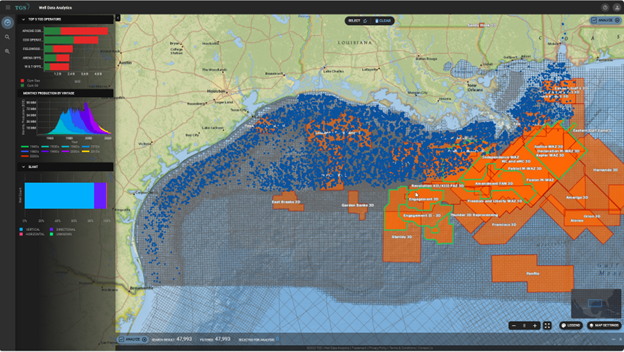

The Gulf continues to be a primary source of oil and gas production in the United States. In 2022, the average oil production from the Gulf of Mexico was about 1.7 million bopd according to TGS Well Data Analytics, which represents about 15% of all US oil production. To assist in the evaluation of production targets, TGS offers a complete set of well data, including interpretation-ready digital logs for roughly 50,000 wells located in the Gulf of Mexico offshore area, as seen in Figure 1. According to a TGS Press Release, “TGS is the official release agent for new offshore well data and does all the digital well log processing for all four BSEE regions (Gulf of Mexico, Pacific, Alaska, Atlantic).” The company has been providing these services since 2004.

(Figure 1) TGS Well Data Analytics application showing all available TGS well data and seismic surveys in GOM.

The most recent bidding event in the US Gulf was Lease Sale 259, which took place in March. During this auction, BOEM secured winning bids amounting to $263.8 million for 313 tracts, involving approximately 1.6 million acres. A total of 32 companies actively participated in the auction, with Chevron, BP, Shell, Equinor, Occidental, Hess, and ExxonMobil emerging as the top bidders.

Although disappointing for prospective bidders, additional time before the lease sale allows bidders to further utilize available TGS seismic and well data to help finalize and reconfirm their leasing decisions. In support of ongoing and future lease sale activity, TGS, in partnership with SLB, continue work on extensive ultra-long offset OBN programs in the US Gulf of Mexico. Fast-Track data for Amendment Phase 2 and Engagement Phase 3 is ready for evaluation, and the acquisition of Engagement Phase 4 has been recently completed. Final data for Sophies Refocus has also recently been completed. The program includes ~6,175 KM2 of newly reprocessed 3D seismic data, helping E&Ps further explore new and existing plays in the areas included in the Gulf of Mexico Lease Sale 261. Sophies Refocus illuminates key subsurface structures and offers new insight into the prospectivity within the deeper sub-salt section by applying advanced imaging techniques utilizing Dynamic Matching FWI technology.

The sale will certainly lead to a forecasted boost for the Gulf of Mexico U.S. oil and natural gas industry, led by Texas and Louisiana markets that have set records in petroleum exploration and exports in the first half of 2023.

For more information on Well Data Analytics or seismic coverage, contact us at WDPSales@tgs.com.