Apache closes on Callon for $4.5B as Permian consolidation trend continues.

Last week, APA Corporation, the parent company of Houston-based oil company Apache Corp, officially announced the successful completion of its acquisition of Callon Petroleum Company. The transaction received unanimous approval from both APA and Callon shareholders during special meetings convened on March 27, 2024. This acquisition significantly bolsters Apache's asset portfolio, reinforcing its presence in the Delaware Basin and cultivating a more balanced Permian Basin asset foundation overall, as seen in TGS Well Data Analytics.

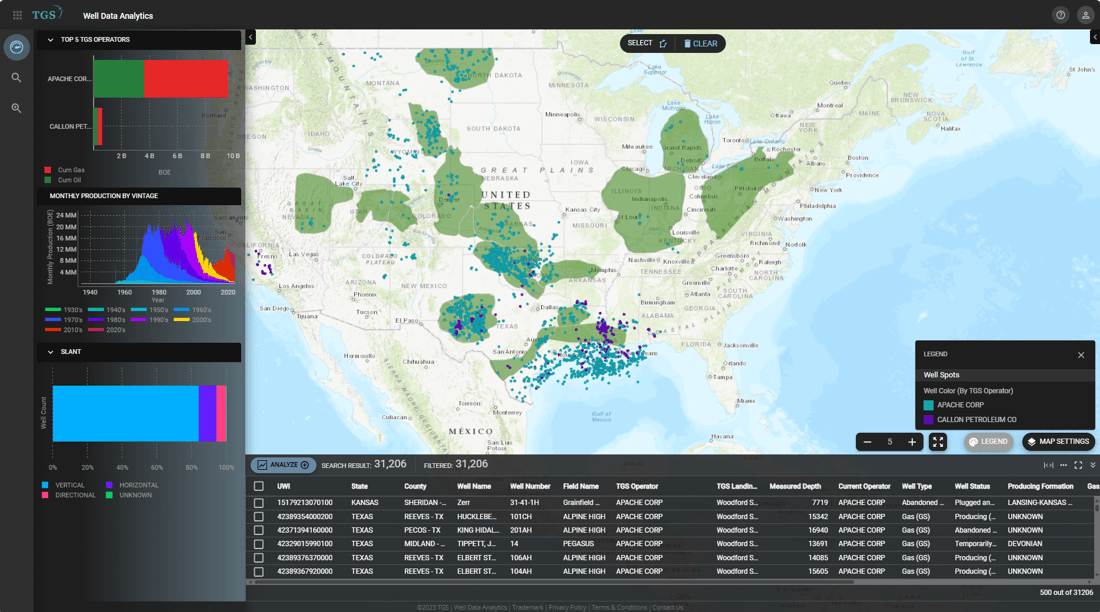

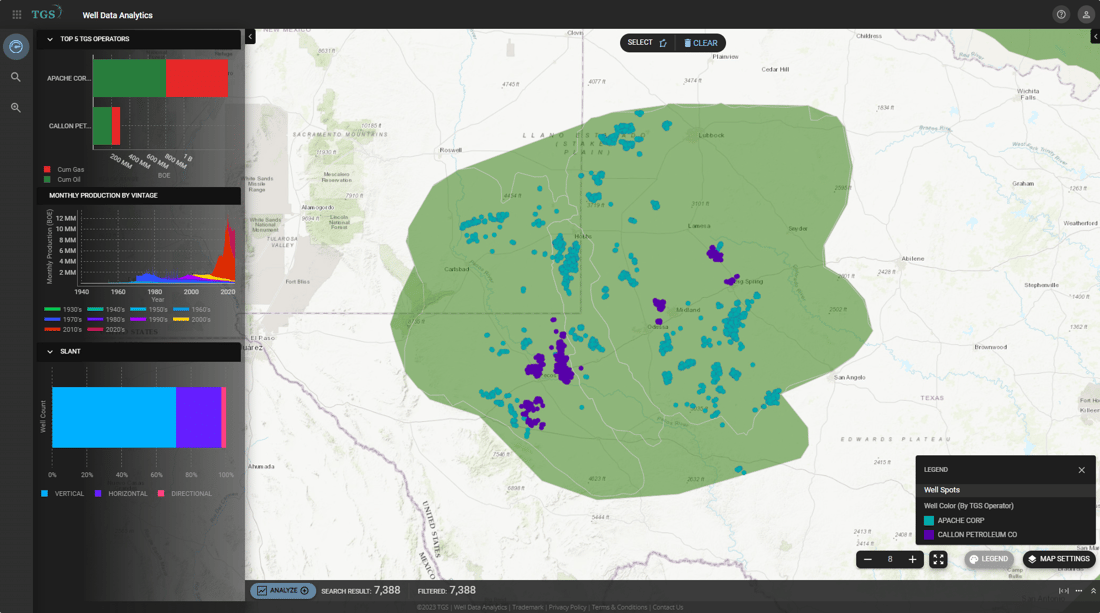

Figure 1 highlights the geographical coverage of all Apache and Callon wells, while Figure 2 zooms in on the active producing Permian Basin wells, utilizing the TGS Well Data Analytics application. Apache's wells are depicted in teal, while Callon's are highlighted in purple. Callon's holdings encompass 120,000 net acres in the Delaware Basin, with certain areas adjacent to Apache assets. This strategic alignment with Callon enables Apache to secure access to "quality rock" with a low breakeven price, providing a significant advantage in the current landscape where acquiring high-quality Permian acreage is increasingly challenging.

Figure 1. TGS Well Data Analytics application showing all Apache and Callon wells, overlay of TGS Stratigraphic Model outline (green).

Figure 2. TGS Well Data Analytics application showing only active producing Apache and Callon Permian Basin wells, overlay of TGS Permian Basin Stratigraphic Model outline (green).

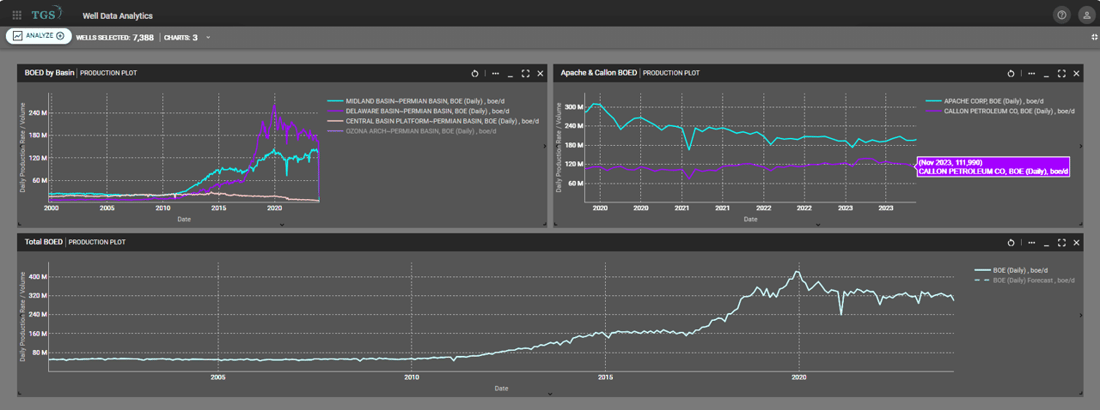

Following the completion of the acquisition, Apache foresees a notable increase in its daily reported production, expected to reach approximately 500,000 barrels of oil equivalent (BOE), primarily sourced from the Delaware Basin. According to TGS Well Data, Callon recorded production of 112,000 BOE per day in the fourth quarter of 2023 (as illustrated in Figure 3).

Figure 3. TGS Well Data Analytics application image showing Apache and Callon’s Permian Basin historical total and by-basin production.

The valuation is enticing, given that the acquisition of Callon was executed at a level aligned with its current production value, without a significant expenditure on undeveloped acreage. With acquisition targets becoming scarcer in the Permian Basin, consolidation becomes increasingly vital for publicly traded firms looking to bolster their presence in this pivotal oil region and make use of economies of scale. Noteworthy potential targets like Permian Resources, Matador, and SM Energy are esteemed for their high-quality inventory. Additionally, Vital and Civitas present attractively valued opportunities for consolidation. Leveraging TGS Well Data Analytics enables swift comparative analysis and benchmarking.

For further details on Well Data Analytics or to schedule a demo, please contact us at WDPSales@tgs.com.