A game changer in the Delaware Basin’s natural gas production

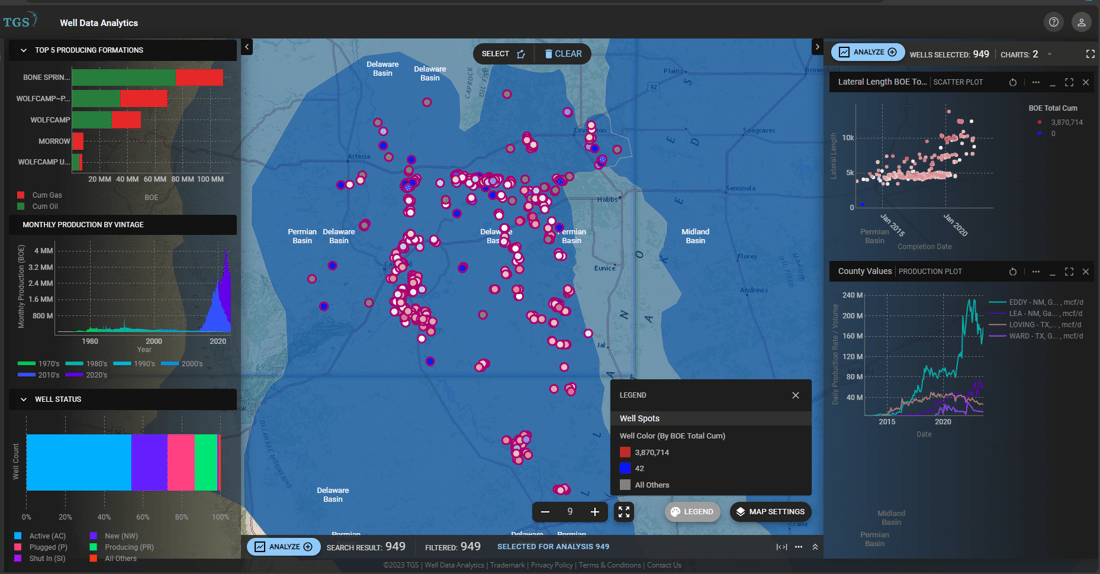

Matador Resources Company is an independent energy company that focuses on exploring, developing, producing, processing, and acquiring oil and natural gas resources in the United States. Their current operations are centered around the Wolfcamp and Bone Spring plays in the Delaware Basin (located in Southeast New Mexico and West Texas), as illustrated in TGS Well Data Analytics in Figure 1. Matador has expanded to approximately 152,200 net acres, producing 154.2 mboe/d and 393.6 mcf/d, according to TGS Well Performance Data. In 2024, Matador anticipates drilling 94 net-operated horizontal wells. Their strategic focus lies on constructing longer laterals, specifically those spanning two miles or greater, according to Matador’s guidance. Matador’s production is currently concentrated in Eddy County, but the focus is shifting to drilling new wells and expanding production into Lea County, as shown in Figure 2. Matador's strategic vertical integration drives production expectations in 2024 by adding a new pipeline expansion project to grow production.

Figure 1. Matador's historical Total Cum boe/d production in the Delaware Basin is illustrated by the TGS Major Basins outline (blue). Using TGS Well Data Analytics, we can see that Bone Spring is the top-producing formation, with approximately 20% being Matador’s new wells to meet 2024 production goals. In addition, Eddy County stands out as the top-producing county, with lateral lengths increasing each year, according to the scatter plot.

These new expansion pipeline projects strengthen Matador’s midstream infrastructure, enhancing their upstream operations and supporting growth objectives in the Northern Delaware Basin. The goal is to improve operations and streamline the transportation of natural gas by establishing connector pipelines for Matador and third-party customers. These pipelines are designed to ensure a steady flow of natural gas, contributing to production stability. The pipelines cover over 20 miles and enable Matador to effectively gather and transport natural gas production from the 21 Dagger Lake South permitted wells, which are expected to be turned into sales in the second quarter of 2024. The natural gas pipeline connection between Pronto Midstream and San Mateo allows flexibility in the gas flow direction, optimizing market conditions, as shown in Figure 2. This also includes the Pronto gas processing plant acquired in 2022 and will support Matador and other producers like ExxonMobil and Mewbourne Oil, contributing to their production goals. The plant will allow Matador to process raw natural gas extracted from wells, separating valuable components, such as methane, ethane, and propane. These components can then be sold or transported to the market, generating revenue. This also supports Matador and the acreage acquired with Advance Energy in Northern Lea County in 2023. These pipeline additions align with Matador’s strategic priorities for production.

.png?width=1100&height=670&name=MicrosoftTeams-image%20(27).png)

Figure 2. Illustrates Matador’s footprint in the Delaware Basin, consisting of active wells (blue), new wells (yellow), and current permits (green). The historical (mcf/d) production of New Mexico within Eddy and Lea Counties was generated using TGS Well Performance data in the Delaware Basin. Matador's new expansion pipelines are highlighted in dashed green/black, while the existing ones are in dark blue. The new gas processing plant (teal) is a key player, along with third-party operators ExxonMobil (red) and Mewbourne Oil Co. (dark blue), contributing to Delaware's gas production.

Matador has executed a firm sales agreement tied to the Gulf Coast Express (GCX) pipeline project. This project connects Permian Basin natural gas directly to the U.S. Gulf Coast LNG terminals, enhancing the natural gas value chain. Matador’s involvement ensures flow assurance and aligns with its long-term growth objectives in the energy sector. The GCX project was designed to transport up to 2 billion cubic feet (Bcf) of natural gas per day from the Permian Basin in West Texas to the Agua Dulce hub in South Texas. This increased capacity helps meet the growing demand for natural gas in the Gulf Coast region, supporting industrial, residential, and commercial consumers in the future.

For more information on TGS Well Data Analytics or TGS Well Performance data, schedule a demo, and contact us at WDPSales@tgs.com.