Jurassic play continues momentum of the last decade, positioning itself as a key driver of future exploration in the region

Last Friday, March 17, Shell announced a final investment decision (FID) for the Dover project targeting the Jurassic Norphlet formation at nearly 30,000 feet. A subsea tieback to the Appomattox product hub, Dover is expected to reach 21,000 BOE/d, contributing to the Norphlet’s growing relevance in the deepwater Gulf of Mexico.

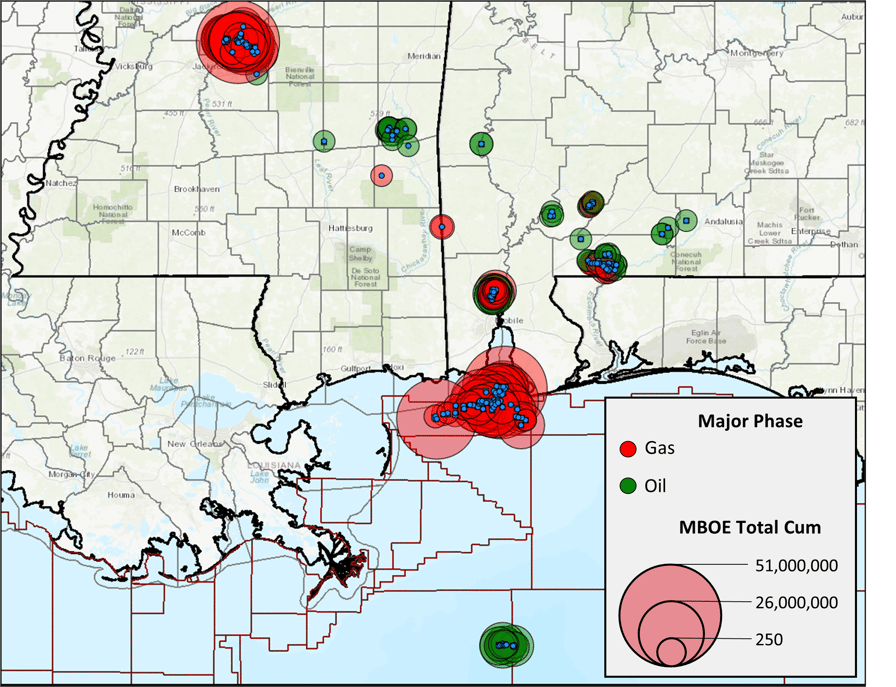

Following first oil discovery in 1967, wells were initially concentrated in the onshore regions of Mississippi and Alabama and gradually moved into shallow waters during the late 1980s and 1990s. Norphlet production grew to nearly 40,000 BOE/d by 1992, continuing to grow until a peak of 175,000 BOE/d in 20121. Although initial production rates were favorable for these wells with maximum production averaging 7,200 BOE/d1, the deepwater segment of the play remained out of reach due to projected drilling depths needed to tap the Norphlet.

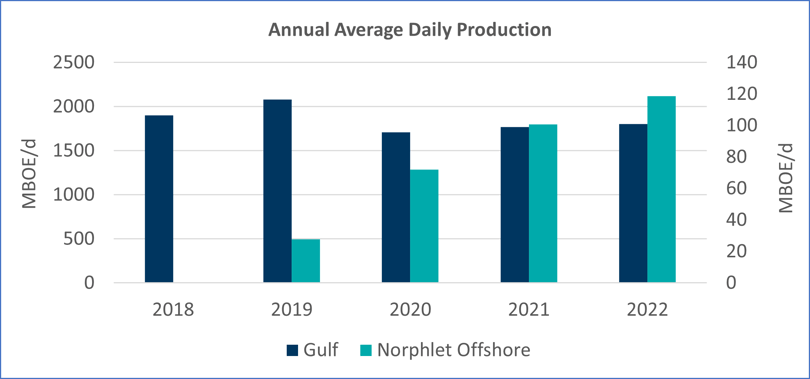

By the early 2000s, drilling technologies caught up to the imagination of geologists, and the first economically viable discovery was made at Appomattox in 2010. Several more major discoveries followed in recent years, with six by Shell, including Dover, and Ballymore by Chevron in 2018. If both Appomattox and Ballymore reach their full design capacity of a combined 225,000 BOE/d, they will comprise 12% of total Gulf of Mexico production, up from 7% currently. Still in the early stages of exploration, the Norphlet has ample room to grow as a significant producer over the next decade.

1TGS Well Data and Analytics