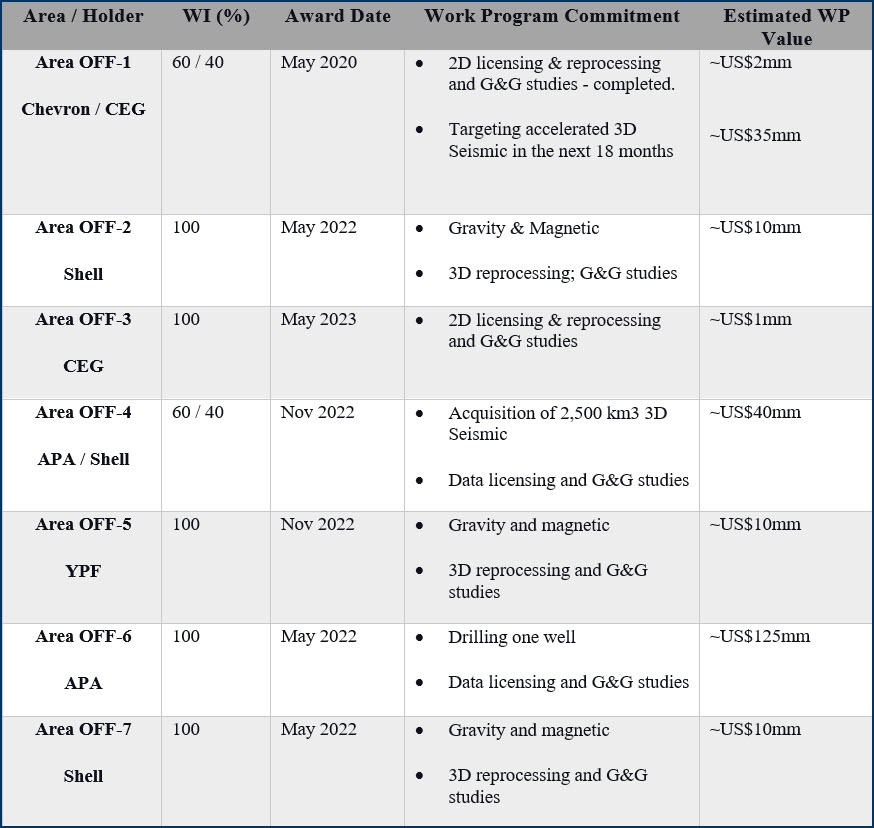

Uruguay’s offshore blocks went from zero to fully licensed in under three years, committing material work programs estimated at ~$233 million.

Uruguay emerges as a new frontier in offshore energy, drawing renewed interest in oil and gas exploration amidst its long-term green hydrogen goals. With its offshore acreage receiving exploratory attention for the first time, Uruguay's emergence has been swift, with Eytan Uliel, CEO of Challenger Energy, noting that within 18 months, the country has secured licenses from major global energy players. This shift follows the discovery by TotalEnergies and Shell of significant oil reserves off Namibia's coast in 2022, which sparked hopes for Uruguay, given the geological similarities between the two regions. Santiago Ferro of Ancap suggests that this development has doubled the probability of finding oil and/or gas off Uruguay's coast to 5-25%.

The Namibian discoveries triggered a surge of interest among energy firms eyeing Uruguay, effectively reducing the country's exploration risks. Among other companies, Challenger Energy holds exploration permits for Uruguayan blocks, with major players like Apache, YPF, and Shell re-entering the market. The country's offshore acreage is set for comprehensive exploratory work, backed by substantial investment commitments from permit-holders, which is expected to exceed $200 million in the coming years.

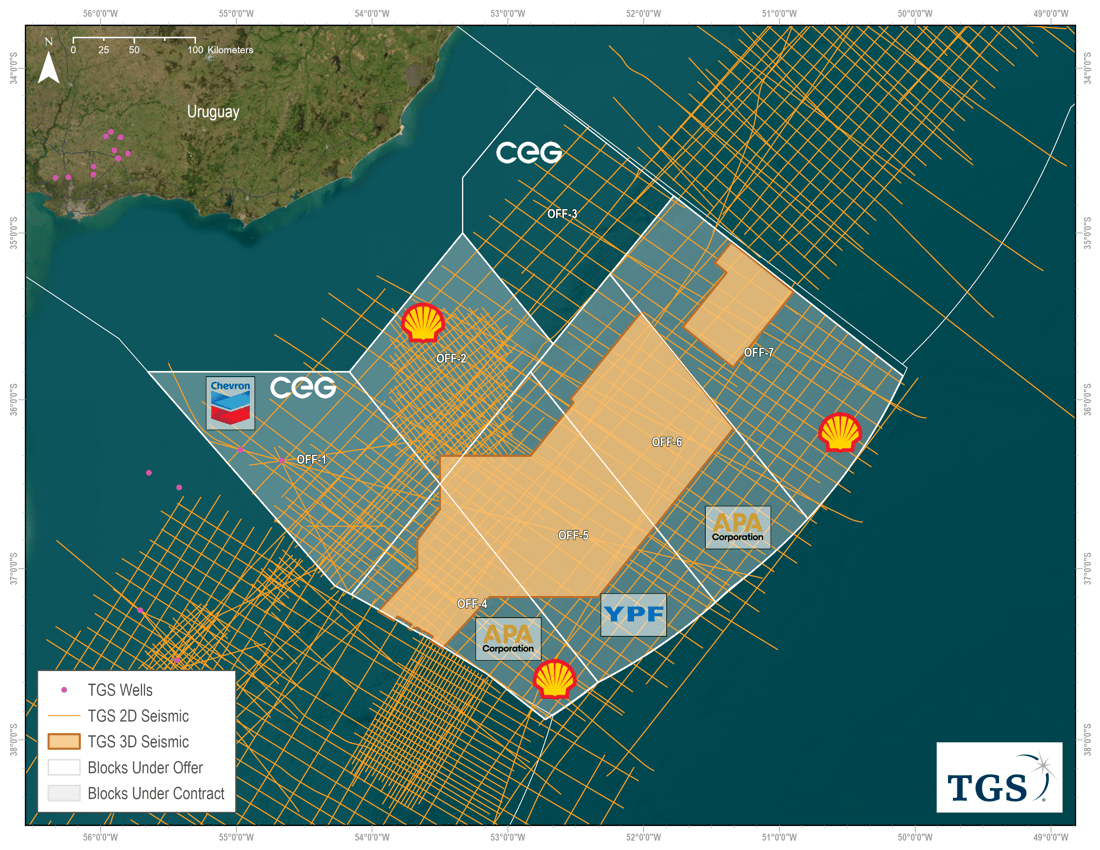

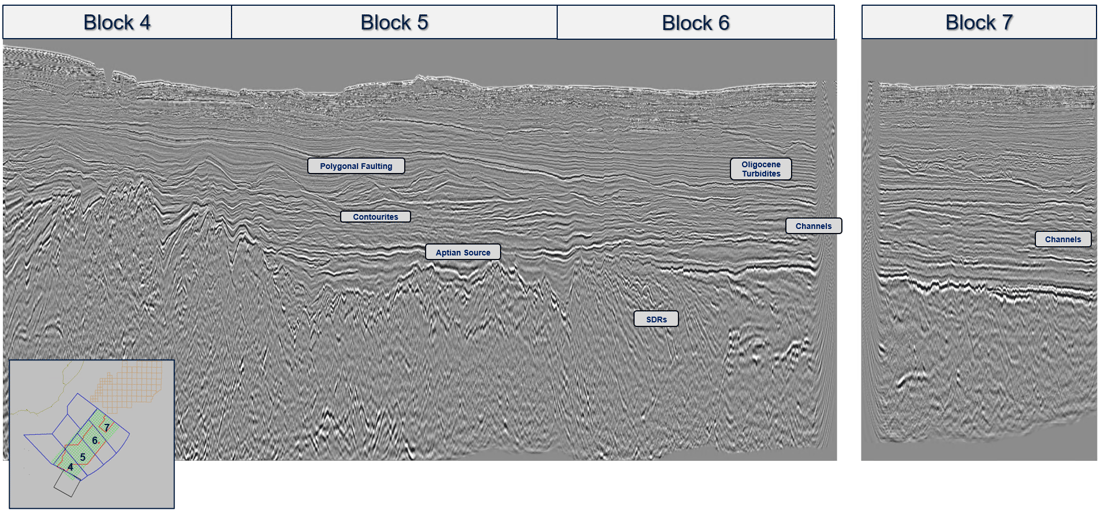

TGS has a long-standing relationship with Uruguay and its leading O&G players. In 2022, the company completed a 3D data reprocessing program, Tannat 3D, in the country. The data was regionally integrated and reprocessed using advanced techniques, including de-ghosting, improved velocities, and pre-stack merge and migration to depth. This newly enhanced data, combined with TGS' existing 23,000 km of 2D seismic coverage in the area (Figure 1), will allow for the definition of play fairways, leads, and exploration targets, providing E&Ps with the best-imaged data to make the most informed decisions to explore and develop the blocks. For example, details of the Namibian conjugate margin discoveries have assisted in the identification of analogous Cretaceous Channel and fan targets in Uruguay, as can be observed in Figure 2 . In addition to the Tannat 3D program, TGS plans to acquire new 3D seismic data in the area in the upcoming years.

Last week, Challenger Energy officially secured the AREA OFF-3 license for oil and gas exploration offshore Uruguay, solidifying its foothold in the region's burgeoning exploration sector. Awarded on June 2, 2023 under the Open Uruguay Round process, the license's first exploration period is set to commence on June 7, 2024, lasting for four years until June 6, 2028. Spanning an area of 13,252 km² in relatively shallow water depths approximately 100 km offshore Uruguay, the AREA OFF-3 block boasts significant existing 2D and 3D seismic coverage, with two material prospects holding an estimated gross resource potential of up to 2 billion barrels of oil equivalent (Bboe) and up to 9 trillion cubic feet of gas (Tcfg).

This announcement follows Challenger Energy's recent farm-out agreement with Chevron Uruguay Exploration, a subsidiary of Chevron, for a 60% interest in the AREA OFF-1 block offshore Uruguay, pending regulatory approvals. These strategic moves underscore Challenger Energy's commitment to expanding its presence and accelerating exploration efforts in Uruguay's offshore sector. The company remains focused on maximizing the potential of its assets while actively seeking partnerships to leverage expertise and resources in advancing exploration activities.

Adjacent to the AREA OFF-3 block lies the AREA OFF-2 block held by Shell, with the Amalia prospect straddling both blocks. To the south are deepwater Uruguayan blocks AREA OFF-6, held by APA Corporation, and AREA OFF-7, held by Shell. The AREA OFF-3 block has witnessed prior seismic activity, comprising approximately 4,000 km of legacy 2D and about 7,000 km² of legacy 3D data. Notably, the block hosts two material-sized prospects, the Amalia and Morpheus prospects, with significant resource estimates (Table 1).

Challenger Energy's obligations during the initial exploration period include licensing and reprocessing of 1,000 km of legacy 2D seismic data and undertaking two geotechnical studies. The company plans to adopt a similar strategy used for the AREA OFF-1 license, focusing on accelerating technical work to high-grade existing prospects and identifying new plays and prospects to attract strategic partners early in the process.

Uruguay's allure lies in its potential reserves and stable economic and political environment, contrasting with neighboring regions marked by instability. Ancap estimates Uruguay's oil and gas reserves to be five billion barrels, although this figure awaits third-party verification. Despite trailing regional heavyweights like Brazil and Guyana in proven reserves, Uruguay's attractiveness stems from its low above-ground risks and reputation for good governance.

As foreign direct investment projects in Uruguay approach record highs, the country's emergence as a promising energy frontier underscores its potential to reshape the regional energy landscape. With substantial exploration activities on the horizon and a conducive regulatory environment, Uruguay stands poised to leverage its offshore potential for sustainable economic growth and development.

For more information on TGS Seismic Products, contact us at latinamerica@tgs.com.

Figure 1. Uruguay’s Exploratory Offshore Blocks Overlaying TGS 2D and 3D Seismic coverage. Source: ANCAP.

Figure 2. A representative inline from the TGS Tannat 3D program highlighting the common seismic facies and potential exploration targets in offshore Uruguay.

Table 1. Material Work Programs committed in the coming years in the various offshore blocks. Source: CEG.