The oil and gas industry is experiencing its highest Q1 deal values since 2017, signaling a significant financial transformation within the sector.

Ongoing consolidations in the U.S. shale industry has led to a significant increase in the global M&A deal value within the oil and gas exploration sector, marking its highest first-quarter level in seven years. Deals surpassing $50 billion have been unveiled in the first quarter of 2024, with publicly traded companies leveraging their elevated share prices to acquire smaller counterparts. The total deal value for January and February has already exceeded levels seen since the first quarter of 2017, representing more than double the amount disclosed in the first quarter of 2023.

Deals have been announced almost every week since the start of 2024. In the first week of January, APA Corporation disclosed its intention to acquire Callon Petroleum, a Permian oil and gas producer, in a deal valued at approximately $4.5 billion. Shortly thereafter, on January 11, Chesapeake Energy Corporation and Southwestern Energy announced a merger through an all-stock transaction valued at $7.4 billion.

Talos Energy's acquisition of QuarterNorth Energy, announced in January and finalized in March ahead of schedule, involved a $1.3 billion transaction combining cash and stock. This strategic deal is anticipated to strengthen Talos Energy's deep-water asset portfolio in the U.S. Gulf of Mexico.

On February 7, California Resources announced a $2.1 billion acquisition of Aera Energy, including debt, with the deal expected to close in the second half of 2024. This combined entity will hold interests in five of the largest oil fields in California.

Notably, Diamondback Energy entered into a monumental $26 billion agreement to acquire Endeavor Energy Resources, aiming to establish a dominant force in the Permian Basin.

In a significant development last week, Chord Energy and Enerplus Corporation reached an agreement to merge in an approximately $11 billion deal involving stock and cash. According to the full-year 2023 guidance, the unified company is projected to achieve a daily production of 254 MBOED across the Williston Basin, distinguishing itself as the largest operator by volume. This strategic consolidation is designed to create a leading exploration and production company with a specific focus on the Williston Basin.

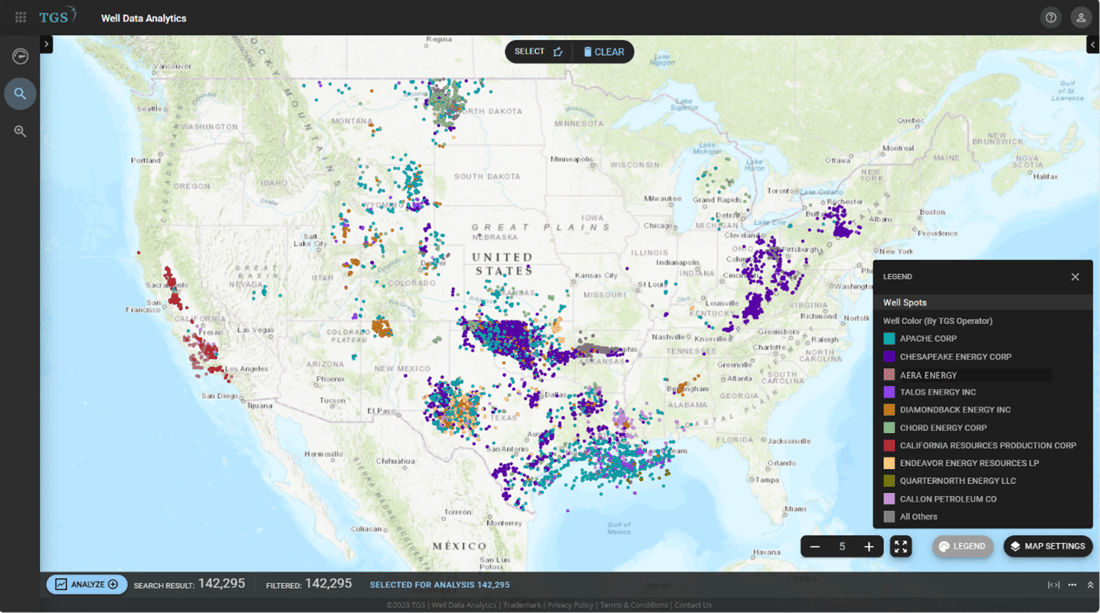

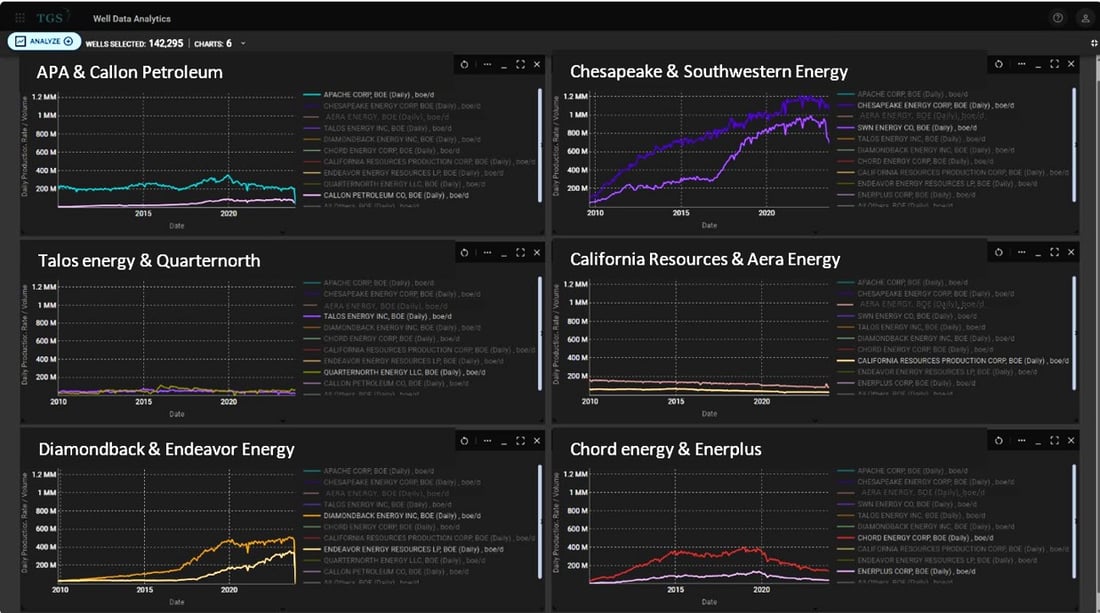

Figure 1 visually represents the geographical coverage of these companies, utilizing the TGS Well Data Analytics application. On the other hand, Figure 2 displays the daily production in barrels of oil equivalent since 2010 for each of the mentioned deals, providing a comprehensive view of their impact on overall production trends.

Figure 1. TGS Well Data Analytics application showing the geographical coverage of these company assets.

Figure 2. TGS Well Data Analytics application image showing the BOE/D since 2010 for each of the mentioned deals.

Industry executives and analysts anticipate that the consolidation trend in the oil and gas sector will persist, driven by elevated stock values and the widespread desire among many firms to acquire additional inventory, particularly in the Permian Basin.

With TGS Well Data Analytics, this type of analysis can be done quickly. For more information on Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com