| TGS insights give you the stories behind Energy data. These regular short 3-5 minute reads feature thought-provoking content to illustrate the use of energy data in providing insight, nurturing innovation, and achieving success. |

The US East Coast is the next large frontier for offshore wind development. From Massachusetts to the Carolinas, wind farm developers alongside federal and local governments are eager to harness their offshore wind through energy-creating turbines.

The U.S. is significantly lagging behind Europe and Asia when it comes to wind energy production, but that is likely to see a rapid change. There are currently 18 commercial lease projects in the permitting and development stages, and the federal government has set a goal of advancing 26 projects through the regulation process by 2025. Many of the current 18 are expected to see energy production before the close of 2025.

Due to the immaturity of the offshore wind industry in the U.S., permitting and development of new projects have been slow. The cause of the delays is complex and includes the need to accurately assess energy production over the 25+ year lifetime of the facility, effectively mitigate environmental concerns, ensure the project is technologically feasible, and prove returns to investors.

However, the U.S., and the East Coast in particular, is in a unique position to solve these delays. Through the adoption of modern turbine technology that is rapidly advancing as global demand increases, the use of cutting-edge weather modeling and guidance by new Federal policies, the area could see exponential growth in the coming years

|

Join the ConversationAt TGS we create unique, actionable insights from raw energy data. These insights can reduce risks and enable a more detailed understanding of natural resource investments. Follow us to #SeeTheEnergy and JOIN THE CONVERSATION >> |

The U.S. Catching Up On Europe

A federal goal of generating 30 GW of energy production from offshore wind by 2030 is currently in place for the US. In Europe, 12 countries combined are anticipating an estimated 110 GW of offshore wind production by 2030, and 6 Asian countries want to achieve around 90 GW by 2030.

Europe currently has 116 operating offshore wind farms across 12 countries, and Asia has been rapidly expanding. Although behind with only one operating farm offshore Rhode Island, the US has been paying close attention to the progress made globally and has initiated new regulations to begin speeding the permitting and development processes. Additionally, the operators capable of initiating these large wind farm endeavors work globally and are actively invested in modern turbine technology to maximize energy production, extend turbine life, and reduce environmental concerns.

The target for the Bureau of Energy Management (BOEM) to complete the review of 26 projects by 2025 would include new commercial leases procured in the upcoming New York Bight lease event, anticipated for 2022.

One essential component for the continued momentum of the project lease, permitting and development activity is accurate weather data. Understanding the daily, weekly, monthly, and annual weather fluctuations is necessary to risk a potential lease area adequately. With its head start, Europe has a significant number of physical weather monitoring buoys recording data continuously whose data can be incorporated to enhance and validate numerical modeling. The U.S. is far behind in continuous physical measurements, but TGS’s upcoming fleet of new floating lidars will help bridge this gap.

Data Needs for Bid Assessments

A major component of preparing a feasible bid is to perform a wind assessment to estimate the wind resource of an area accurately and anticipate the energy output of each wind turbine for the entire lifecycle of the project. Lease area assessments are complex, and many factors need to be evaluated, including engineering and technology limitations, financial concerns, scheduling restraints, and environmental and federal regulations.

A precise and reliable wind-resource assessment will have a direct impact on reducing uncertainty. It will allow lease competition to utilize the most recent scientific advances to increase the wind farm's performance, which will improve the profitability of the project throughout its lifecycle. A trusted and accurate wind resource assessment will drive the decisions for sourcing the best turbine technology and determine optimal placement patterns. Thereby, energy production will be optimized, and planners can more reliably predict the financial budget necessary to develop and maintain the project while providing a profit to the shareholders throughout the project's duration.

Advanced Weather Modeling

The most advanced computer model that uses physics-based rules to explain and predict the physical atmosphere is the Weather Research and Forecasting (WRF) model. The National Center for Atmospheric Research, the National centers for Environmental Prediction and the Forecast Systems Laboratory are a few of the institutions that help collaborate and develop the WRF as an open-sourced numerical weather prediction (NWP) model.

Vaisala and energy data specialists TGS have developed a three-pillar approach that combines the sophisticated WRF model with onsite observational data and machine-learning algorithms. This approach provides a reliable and cost-effective assessment that can meet the demands of the competitive market to review large areas in a short window of time.

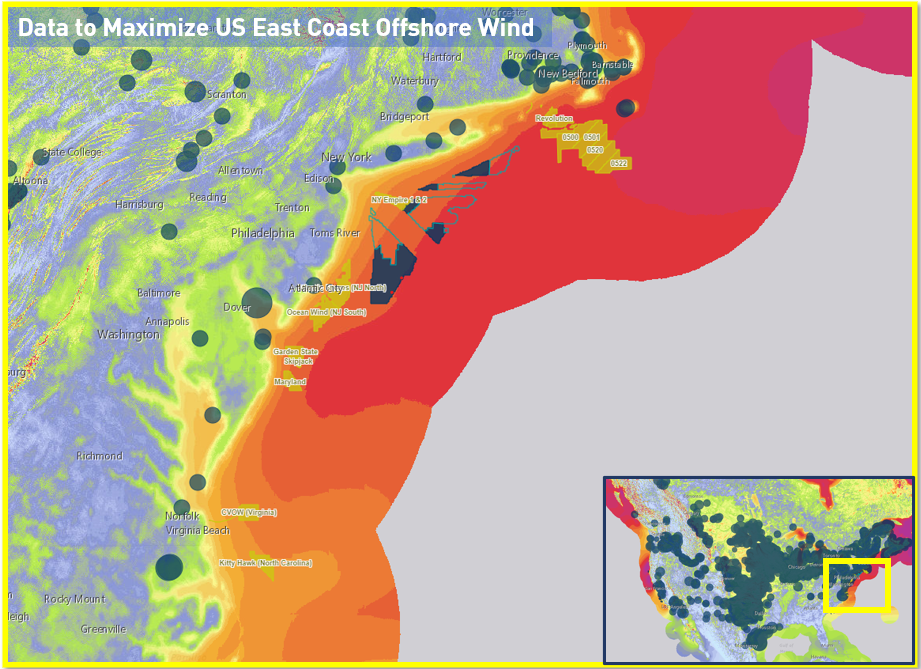

Map of East Coast US illustrating location of TGS Wind Assessment and current and upcoming lease areas.

Map of East Coast US illustrating location of TGS Wind Assessment and current and upcoming lease areas.

This particular three-pillar method integrates the rich datasets available from the WRF model with observational measurements taken from LIDAR buoys and other weather stations. It uses supercomputers to run advanced machine learning algorithms on the data. The wind assessment generated from this approach provides a model with increased accuracy that can predict short and long-term wind behavior and variability, regardless of proximity to physical measurements. This approach reduces the cost and time involved in deploying observational stations while maintaining the accuracy needed to assess the parameters required to maximize energy production from the wind farm.

East Coast Lease Activity

Plans are in place to offer bidding and lease opportunities over the next two years in new areas offshore New Jersey, Maryland, Connecticut, and New York. There is also momentum to develop new acreage in Virginia and the Carolinas. Offshore New York, the "New York Bight" area saw six lease blocks made available during Q1 2022 with projects developed from this lease are estimated to bring up to 7 GW of energy production to the grid, making it the largest lease event in US offshore wind to date.

The East Coast is in a unique position to leverage the experience and technological developments that have been refined in Europe, making it possible to decrease the time it takes to bring a project online. Companies like Equinor, Ørsted, Avangrid, EnBW, BP, and many others who have specialized in offshore wind development across Europe are bringing their experience to the U.S. Their knowledge of navigating the regulation and permitting processes and their technical development acumen will undoubtedly be leveraged in their expected participation in the NY Bight bid round.

The future of offshore wind energy in the U.S is promising. A windfall of positive enforcement from federal and state regulators to promote an ambitious timeline combined with the drive from energy and data analytic companies to provide reliable engineering and scientific data will provide the tools necessary to meet the 30 GW goal by 2030. As seen in Europe, the utilization of detailed wind resource data in the development process makes it possible to mitigate risk and increase energy production and profitability while reducing overall energy costs to consumers. The U.S. hopes to benefit significantly from the lessons learned in Europe to enable exponential growth in offshore wind development over the next ten years.